ABOUT US

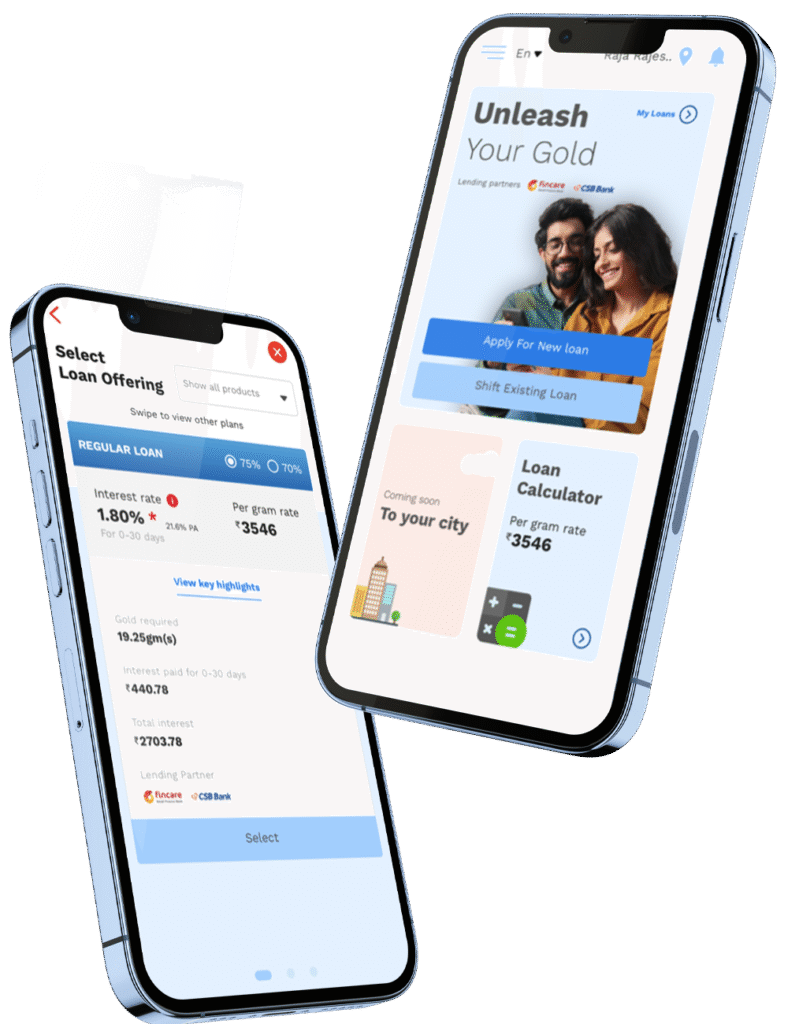

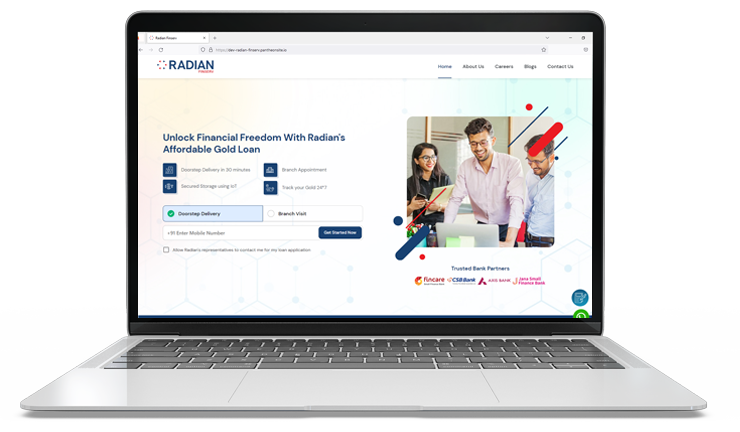

Radian provides an array of financial products, to help clients meet their financial needs through our affordable and convenient solutions.

Our story

Radian Finserv is an RBI approved NBFC that aims to revolutionize the lending industry in India. By leveraging technology and data analytics, Radian Finserv is able to offer loans at competitive interest rates and with minimal paperwork. With a strong commitment to customer service, Radian Finserv is constantly innovating to make the lending process as easy and hassle-free as possible.

Radian recognizes the importance of the human touch in financial services, especially for tasks that require empathy or decision-making skills. To that end, we combines technology-driven processes with a strong commitment to exceptional customer service to offer the best of both worlds. Radian’s founding team is highly competent in implementing plans and delivering top-notch solutions to their customers.

Radian operates in the Gold loan, MSME secured and unsecured loans market and has plans to expand into other retail lending products. The company’s well-established distribution network covering five states in India, with 28 branches as on Jan 31, 2025, is intended to provide a seamless and convenient experience for customers.

Radian is dedicated to innovation and exceptional customer service, and the organization approach to financial services combines the latest technology with the human touch to meet the evolving needs of consumers

Start with Radian

Vision

To provide financial solutions to underserved customers through a range of products and offerings in a transparent and trustworthy manner. To help enhance the financial well-being of our customers while upholding the highest standards of probity.

Mission

To foster a culture of execution and excellence, and to provide seamless and superior service to customers through efficient use of technology, in a compliant manner, through a quality workforce.

Our Values

Our core values at Radian play a vital role in shaping a high-performing organization. See how they guide us every day.

Customer-first

Radian prides itself on being a customer-first organization by providing end-to-end customer support.

Innovation

We are creative and open-minded. We are solution-oriented and seek to prioritize technology to solve problems.

Excellence

We set high standards and challenge ourselves not to just get by. We are bold and we move fast. We have a bias for action.

Integrity

We value integrity and see it as binary. We do not take kindly to unethical behavior. We walk away from business opportunities where our principles are compromised.

Passion

We relish what we do. We have fun at work and enjoy the company of our colleagues. We value diversity: of people, of thought, of work styles.

Respect

We respect our customers, employees, partners – our behaviour and work display this. We care for people’s time.

Process adherence

We are in a distributed business where the core ingredient for success is following a standard process, with no deviations. We place emphasis on compliance and do not look for shortcuts.

Radian at a glance

We strive to be the innovators in building an inclusive and sustainable future of MSME Loan in India.

In just two years we have serviced more than 25,000 customers across our branches.

Customers

Branches

Cities

States

As on Oct, 2025

Our Team

Our strategic vision to be the most trusted loans company is anchored in the RADIAN’s Executive Leadership team and our Board of Directors. Meet the leaders who are setting our course for transformation.

Sanjiv Bhasin

Sanjiv Bhasin Sumit Sharma

Sumit Sharma Sunil Khanna

Sunil Khanna Pushpa Latha

Pushpa Latha Sanjiv Bhasin

Sanjiv BhasinSanjiv Bhasin is a career banker with over 40 years of rich experience in the banking industry. He has worked in various leadership positions with large multi-national banks such as HSBC, Rabo Bank, DBS, and AfrAsia spanning Asia, Africa, and the United Kingdom. He has played an instrumental role in the formulation of regulations involving the financial services industry in different jurisdictions.

His expertise range from risk management, governance, and back-office controls to building the right team to create a meaningful impact amidst the competitive landscape. In the last decade especially, he has keenly focused on establishing digital platforms to redefine customer experience and increase market outreach across multi segments, services, and jurisdictions.

At Radian, he provides strategic guidance to build a culture of delivering business excellence and establishing a brand that truly understands the retail lending segment.

— Sanjiv Bhasin, Chairman

Sumit Sharma

Sumit SharmaSumit has worked in corporate, consulting and operational roles, spanning country, regional and global mandates in his over 25 years of experience. He has worked across multiple geographies and has gained experience in business strategy, operations and people practices across different industries.

His primary experience has been in financial services, where he worked with HSBC (Mumbai, Hong Kong, London, Jakarta) and DBS (Singapore). He also held leadership positions in Telenor, and Jana Small Finance Bank, prior to co-founding Vector Finance, a microfinance institution incorporated with the vision of financial inclusion and women empowerment.

Sumit has significant experience in scaling up and transforming organizations. He co-founded Radian in 2020, and provides leadership to the organization, overseeing different functions and setting up the strategy and functioning of Radian.

He holds an MBA from INSEAD, Fontainebleau, France, and is an alumnus of XLRI, Jamshedpur.

— Sumit Sharma, Chief Executive Officer

Sunil Khanna

Sunil KhannaSunil Khanna is a seasoned and thoughtful leader with a unique track record of running and scaling businesses. He has held leadership roles for over two decades across India, Indonesia, Singapore, the United Kingdom, and the United States of America in ABB, DCM Data Products and Hindustan Aeronautics Ltd.

He is the Non-Executive Chairman at Vertiv Energy (previously Emerson Network Power), India, since 2020, prior to which he was the President and MD at Emerson Network. He is a founding member of the Automation Industry Association and was the Chairman of the CII Maharashtra Council from 2015-16.

At Radian, he is the mentor for the growing team and provides key guidance on operational aspects and the overall strategy of the business. He holds an M. Tech in Electrical Engineering from IIT, Kanpur and B.Tech in Electronics Engineering from IIT-BHU.

— Sunil Khanna, Independent Director

Pushpa Latha

Pushpa Latha– Pushpa Latha- Vice President – MSME

Rajesh K

Rajesh K Rohit Kedia

Rohit Kedia Vijay Raghupathi

Vijay Raghupathi  Joe Praveen

Joe Praveen Rajesh K

Rajesh KRajesh brings over 24 years of expertise in the retail financial sector and currently leads the MSME vertical at Radian Finserv as the Business Head – MSME. With a strong background in secured and unsecured lending, he drives the company’s operations, business development, and strategic initiatives in the MSME segment.

Prior to joining Radian Finserv, Rajesh served as the Zonal Business Head for Micro Business Loans in South India at IDFC First Bank. His extensive career includes leadership roles at prominent institutions such as ICICI Bank Ltd, Fullerton India Ltd, Jana Small Finance Bank, and Vistaar Finance.

Rajesh’s core strengths include sales and distribution, channel management, product development, and risk management. He is a seasoned professional in MSME secured lending, excelling in credit policy formulation, appraisals, and portfolio management. Additionally, his expertise extends to fintech processes and technology frameworks, which he leverages to enhance efficiency in retail secured lending and microfinance operations.

At Radian Finserv, Rajesh oversees a wide range of responsibilities, including sales and marketing, credit and risk management, training, and budget planning. His leadership is instrumental in driving growth and delivering value to stakeholders.

Rajesh holds an MBA from Annamalai University and is a certified alumnus of the Advanced Program in Leadership from IIM Bangalore, further solidifying his credentials as a dynamic and results-oriented leader.

– Rajesh K- Chief Business Officer

Rohit Kedia

Rohit KediaRohit Kedia is a seasoned finance professional with a career spanning over a decade. Rohit has a diverse background, having worked in leadership roles for prominent organizations such as KPMG, Stellaris Venture Partners and consulting sectors.

Rohit has accumulated extensive experience across diverse sectors, including private equity, technology, healthcare, and startups, establishing himself as a significant player in the financial landscape. His skill set encompasses IFRS, Ind AS, US GAAP, statutory audits, financial analysis, process improvements, and internal controls.

Rohit is set to spearhead the financial operations and strategy at Radian. With enriching experience in accounting, financial reporting, and direct taxation, his background in venture capital and consulting sectors adds a unique edge to our dynamic team.

He hold Chartered Accountant from The Institute of Chartered Accountants of India.

– Rohit Kedia- Chief Finance officer

Vijay Raghupathi

Vijay Raghupathi Vijay is a seasoned leader with over a decade of experience in banking collections, specializing in both secured and unsecured portfolios. His expertise lies in driving operational efficiency, optimizing recovery strategies, and leading high-performing teams to consistently deliver exceptional results.

In his previous role as Assistant Vice President – Collections at Barclays PLC, Vijay played a critical role in shaping and executing collection strategies, earning recognition for his dynamic leadership and strategic foresight. Prior to that, he held key responsibilities at Standard Chartered Bank, where he led performance management initiatives and successfully delivered on aggressive targets.

A native of Coimbatore, Vijay has called Bangalore home for the past 18 years, where he resides with his wife and two children. He is known for his strategic acumen, calculated risk-taking, and entrepreneurial mindset. These qualities have enabled him to excel in complex, fast-paced environments, driving sustainable growth through operational discipline.

At Radian Finserv, Vijay serves as the Head of Administration and Collections. In this role, he is focused on enhancing collection efficiency, streamlining branch operations, and implementing robust recovery strategies to strengthen the organization’s financial stability. He holds a Bachelor’s degree from Madurai Kamaraj University and brings with him extensive hands-on experience that shapes his pragmatic approach to business transformation.

– Vijay Raghupathi – Admin and Collection Head

Joe Praveen

Joe PraveenJoe brings over 10 years of extensive experience to the Non-Banking Financial Company (NBFC) sector, with deep expertise spanning finance, product management, operations, and technology development.

As a member of the Radian leadership team, Joe focuses on advancing product design, driving innovation, and accelerating digital transformation within the retail lending space. Prior to joining Radian Finserv, he held a critical product role at Real Touch Finance Limited (RTFL), where he was instrumental in developing lending products and managing partnerships across B2B and B2C segments. His previous leadership roles at InCred Finance, Edelweiss, and Capital First Limited saw him contribute significantly to product strategy, operational efficiency, and digital initiatives.

Throughout his professional journey, Joe has established a reputation for operational excellence. His core strengths lie in technology frameworks, product development, and operational management. He is a seasoned professional in building SME and digital lending businesses, with proven capabilities in fintech processes, partner management, and portfolio oversight.

At Radian, Joe oversees product design, digital frameworks, and business development while continuously refining operational processes. He plays a pivotal role in driving sustainable growth and delivering long-term value to stakeholders.

Joe holds a BE in Electronics and Communication Engineering (ECE) from Anna University. An active researcher, he published and certified research papers in journals such as the International Conference on Soft Computing and Innovative Engineering (ICSIE) in 2015. Additionally, he was honored with the Rajya Puraskar (Governor’s Award) for his outstanding contributions to social responsibility.

– Joe Praveen –